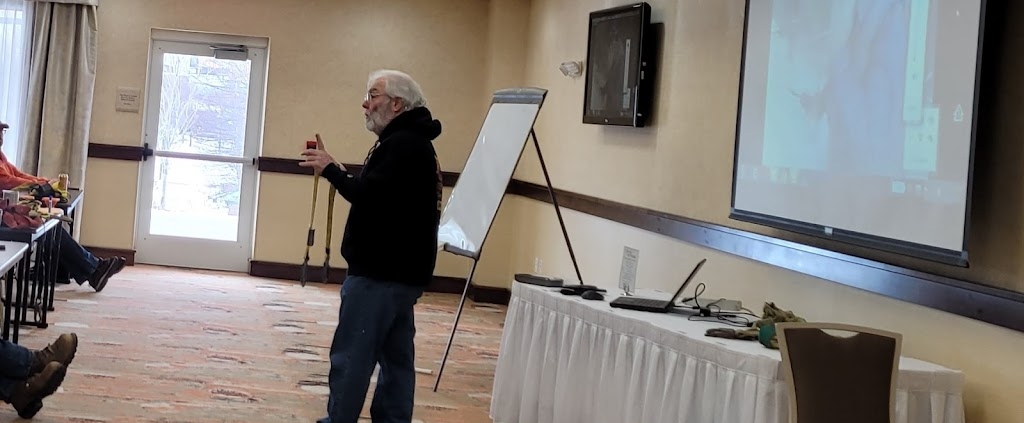

EMI Guide Rail’s Annual Safety Forum

Special thanks to Emmy Ingalsbe and the management team at EMI Guide Rail, LLC, for having Lovell at their annual safety forum held on March 27, 2023, at the Double Tree Hotel in Schenectady. Robert Labombard, Lovell Assistant Director of Safety and Jeanine Deyo, Lovell Regional Claims Representative participated and presented to EMI staff. Safety is what drives safety group performance and this year members of safety group #469 will be enjoying a 27.5% dividend!

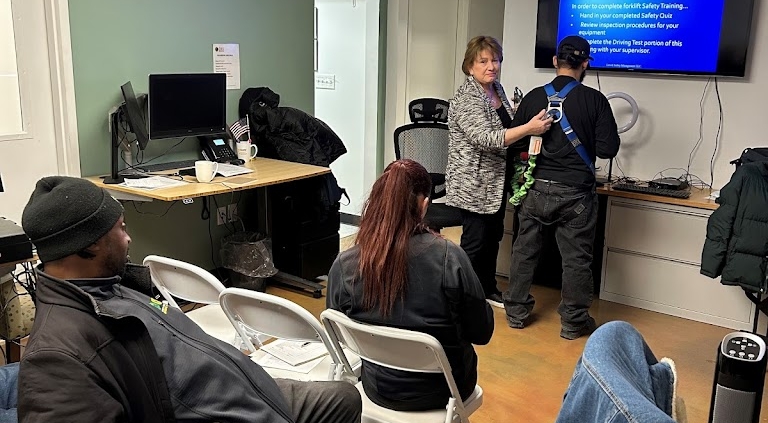

Fall Protection Training for CRS

Safety is what drives safety group performance and at Lovell, we don’t just promise safety services – we deliver! Susan G. Fahmy, Vice President and Director of Safety at Lovell provides fall protection training to employees of our business partner CRS – Corporate Relocation Systems Inc.. Members of Safety Group #251 – NYS Movers, Truckers, & Warehousemen have proven that safety pays with their most recent dividend of 32.5%.

5th Annual Safety Executives of New York Annual PDC

Susan Fahmy and Wael Khalil recently attended a safety professional development conference so that we can stay up to date on what is going on in the safety industry. The theme of the 75th annual Safety Executives of New York Annual PDC was psychosocial hazards, risks and prevention. Fun fact: Susan was a past president of SENY!

Bloodborne Pathogens & Infectious Diseases Awareness training at Jefferson Concrete Corp.

John Macvittie, Lovell Safety Consultant provides Bloodborne Pathogens & Infectious Diseases Awareness training last week to staff at Jefferson Concrete Corp. Special thanks to our business partner Jefferson Concrete Corp., the mutual commitment to loss prevention is what drives the consistent dividends in Lovell’s Workers’ Compensation Safety Groups. To date, Lovell customers have received over $1.15 BILLION in dividends.

Forklift Training for Vicon Industries

There’s a reason why Lovell Workers’ Compensation Safety Group’s consistently outperform the market – a working partnership with our clients to improve safety and drive down their workers’ compensation costs! Nick Lisio, Lovell Safety Consultant gets a special thank you from our partners at Vicon Industries Inc. for conducting Forklift Certification Training!

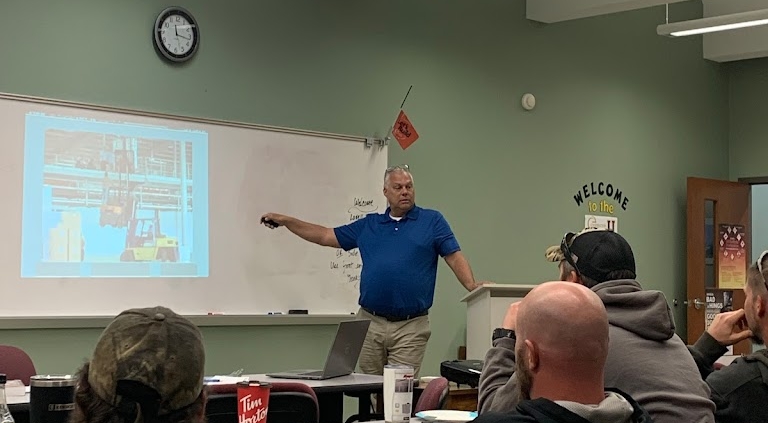

JC Duggan Forklift Safety Training

Lovell Safety Consultant, Wael Khalil conducted Forklift Certification Training on 3/15/23 at our policyholder JC Duggan Inc.’s Brooklyn location.

Safety Pays Dividends to the tune of 32.5% for those in Lovell Workers’ Compensation Safety Group #251!

Training Session for Fall Protection

Safety pays Dividends! John Macvittie, Lovell Safety Consultant conducts a half day training session on fall protection for members of the NNYBE (Northern New York Builders Exchange, Inc.). Lovell’s workers’ compensation programs are more than a certificate of insurance, coverage comes with meaningful services that help drive better performance!

Understanding the New Experience Rating Formula

Steven Bell

Lovell Safety Management Co., LLC

Vice President, Underwriting & Sales

Insurance had its start in the Guilds and maritime trade of Europe. Tradesmen in Guilds would pay into a pool to cover loss due to fire, theft, or disablement. Underwriters would buy shares of a ship’s cargo, thereby spreading their risk of loss among multiple ships. Workers’ compensation insurance attempts to solve a similar risk of loss by spreading the cost of worker injuries over many employers in similar trades or businesses.

In New York State, workers’ compensation rating begins with the creation of what is known as a loss cost for 580 classes of businesses such as plumbers, electricians, and office workers. The loss cost is created by taking the total losses for those in a similar class of business and dividing it by the total payroll for those same businesses. The result is the loss cost, which is an average unit of cost that can be charged for each one hundred dollars of payroll exposure.

If we know one thing about averages, it is that they can be unfair, because not everyone is average. The experience rating formula attempts to solve this problem by tailoring the cost of insurance through an additional credit or debit for each employer based on their individual loss experience.

In year one of implementation, the experience modification will be the lowest of either the new formula, the claim capping procedure, or the old formula plus 30 points. In year two, it will be the lowest of the new formula or claim capping procedure.

There are two core principles that apply to both the old and new formula. First, larger businesses with more employees and higher payrolls are more likely to produce consistent results. Second, the fact that a loss occurred has higher predictive power than the relative cost of a given loss.

What can an employer do to impact their experience rating?

The obvious answer is stop having losses. This is easier said than done but should be the primary goal as the cost of an injury is much greater than the impact to your insurance costs. The losses and exposure used in the formula generally consist of 3 years, so if your policy renews on 4/1/23, the three years used in the formula are 4/1/19 through 4/1/22. This means actions taken today won’t impact your experience modification for another couple of years.

Creating a culture of safety will pay dividends beyond the reduction of losses. One key strategy involves considering paying for non-reportable injuries as set forth in section 110 of the NYS WC Law. To summarize, if an injury requires two or less first aid treatments, no loss time beyond the work shift, and is not permanent in nature or involves injury to the face, then you as an employer have the option to self-pay. If the injury requires further treatment or loss of time, you can report it at that time noting you initially treated it as a first aid claim.